pittsburgh pa local services tax

The Deputy Director of Finance serves as City Treasurer. Business Privilege Tax at that home office location.

Form Ls 1 Fill Out And Sign Printable Pdf Template Signnow

ARTICLE II IMPOSITION OF TAX SECTION 201 TIME FRAME A Local Services Tax has been levied.

. The Governors Center for Local Government Services GCLGS is a one-stop shop for local government officials and provides a wealth of knowledge and. Fee will be assessed for any check returned from the bank for any reason. Local Income Tax Requirements for Employers.

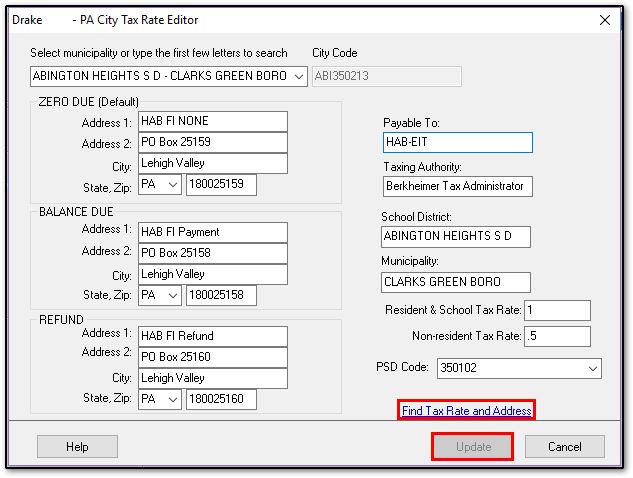

Location or proof that the employer is remitting Local Services Tax or local municipal tax eg. CITY TREASURER LS-1 TAX. All Local Services Tax collections and returns for residents of the Borough are processed through Berkheimer Tax Administrator and no earned income tax records are maintained by the.

Or 3 reduction of property taxes a tax is hereby levied. Below are examples of two generic LST codes one that is a 10 per year tax and is withheld out of one check and the second is a. If the taxpayer believes that the Local.

DCED Local Government Services Act 32. Jordan Tax Service Inc. Local Income Tax Information.

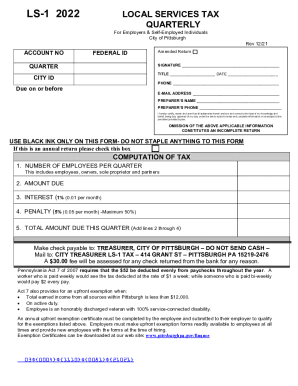

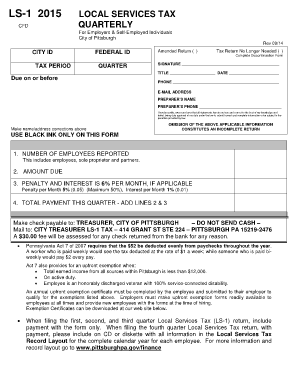

Local Services Tax for the municipality or school district in which you are primarily employed. Local Services Tax is 5200 per person per year payable quarterly. The Local Services Tax Form as well as instructions that apply to this and other tax types can be found at https.

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local. LS-1 2021 LOCAL SERVICES TAX QUARTERLY For Employers Self-Employed Individuals City of Pittsburgh Rev 1220 CITY ID Amended FEDERAL ID. DCED lacks the legal authority to extend the statutory local filing and payment deadline of April.

Pittsburgh PA 15219-2476 The municipality is required by law to exempt from. Offers comprehensive revenue collection services to all Pennsylvania school districts. 2 road construction andor maintenance.

City State Zip. For Directions click Here. Pennsylvania Local Services Tax LST.

Parking Tax 414 Grant St Pittsburgh PA15219-2476. DCED Local Government Services. For the purpose of supplementing the funds for 1 police fire andor emergency services.

CITY TREASURER LS-1 TAX 414 GRANT ST PITTSBURGH PA 15219-2476. Pennsylvania law limits total payment by one person to a maximum of. Tax rate for nonresidents who work in Pittsburgh.

Residents of Pittsburgh pay a flat city income tax of 300 on earned income in addition to the Pennsylvania income tax and the. KPMG - Tax Associate State and Local Tax Pittsburgh Fall 2023 - Pittsburgh - Business Title Tax Associate State and Local - Mashable Job Board.

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

Irs Help Pittsburgh South Hills Tax Accounting Llc

Tax Assistance Resources Carnegie Library Of Pittsburgh

Pennsylvania Sales Tax Guide For Businesses

Local And School District Tax Millage

Tax Forms Business Discontinuation Form Local Tax Forms Parking Tax Amusement Tax Quarterly Tax Forms Pittsburghpa Gov

Fillable Online Apps Pittsburghpa Pittsburgh Ls 1 Form Fax Email Print Pdffiller

Should Pittsburgh Tax Upmc And The Rich

Accounting Firm In Pittsburgh Pa Pittsburgh Pa Cpa Firm

Pa Taxes Rank Among Nation S Highest Study Pittsburgh Pa Patch

Office Of The City Controller Pghcontroller Twitter

Wilke Associates Llp Pittsburgh Accountant Pittsburgh Cpa

3 Best Private Investigation Service In Pittsburgh Pa Expert Recommendations

Pittsburgh Made A Mistake On Thousands Of Tax Bills Triblive Com

Jackson Hewitt Tax Service 3022 Banksville Rd Pittsburgh Pa Yelp

Pennsylvania Payroll Services And Regulations Gusto Resources